Why AI People Should Care About Quant

The current generation of large language models is impressive engineering, but fundamentally limited. Every output — each word of text, each pixel of an image — is a maximum likelihood approximation based on training data probabilities. This ceiling creates real challenges for enterprise applications, robotics, and autonomous driving, where progress remains exploratory.

But there's a class of problems where today's AI architectures are genuinely valuable: domains that don't require real-world logical interaction, only judging outcomes based on feature values to select optimal strategies. Stock and options trading is the prime example. Markets produce structured numerical data, clear reward signals (profit or loss), and decades of historical training data. This is exactly where reinforcement learning excels.

The question isn't whether AI can trade. It's why the barrier to entry has historically been so high — and whether that's changing.

What Traditional Quant Trading Actually Is

The mystique around quantitative trading intimidates newcomers. You hear that it's a field of math geniuses obsessed with algorithms. After diving in deeply, I can clarify:

- The "math" involves decades-old indicators and fixed formulas, now encapsulated in programming libraries — no need to derive them yourself.

- Quantitative strategies entail tweaking and recombining these formula parameters, then testing on historical data.

- Quant strategy models are far less complex to train than billion-parameter LLMs or diffusion models.

- Current stock "Agents" — feeding OHLCV data and news to GPT-4o or similar models for investment advice — are unreliable for serious use.

That last point deserves emphasis: if simply throwing data at large language models worked, every fund would already be doing it. These models aren't trained with market-specific datasets or loss functions. Their decisions are untrustworthy for professional capital allocation.

Quantitative strategy is essentially fitting a complex function.

The function's parameters are indicator combinations, outputting buy/sell actions likely to profit. Traditional quant seeks optimal parameter nesting and combinations through backtesting.

Why Quant Funds Seem Mysterious

The mystery isn't intellectual complexity — it's information asymmetry and operational barriers. Starting a fund requires capital, licenses, industry experience, and connections. Most individuals can't launch their own fund.

So why are firms like Jane Street, Citadel, and Renaissance so profitable? Several factors compound:

- High-Frequency Trading (HFT): Relies on speed — co-locating servers with exchanges, optimizing network latency to microseconds — and market-making rebates. Not complex AI, but extreme engineering.

- Volatility capture: Profits increase in volatile markets where pricing inefficiencies widen.

- Trend exploitation: Accurate fundamental predictions during extended bull markets (e.g., U.S. equities 2019–2024) yield outsized returns.

- Early-mover advantage: Early quant funds outpaced less tech-savvy institutions and retail investors, though competition now intensifies.

- Speed of reaction: Jane Street's 2024 dominance in India's options market, capturing roughly 70% of profits via HFT, is a striking example.

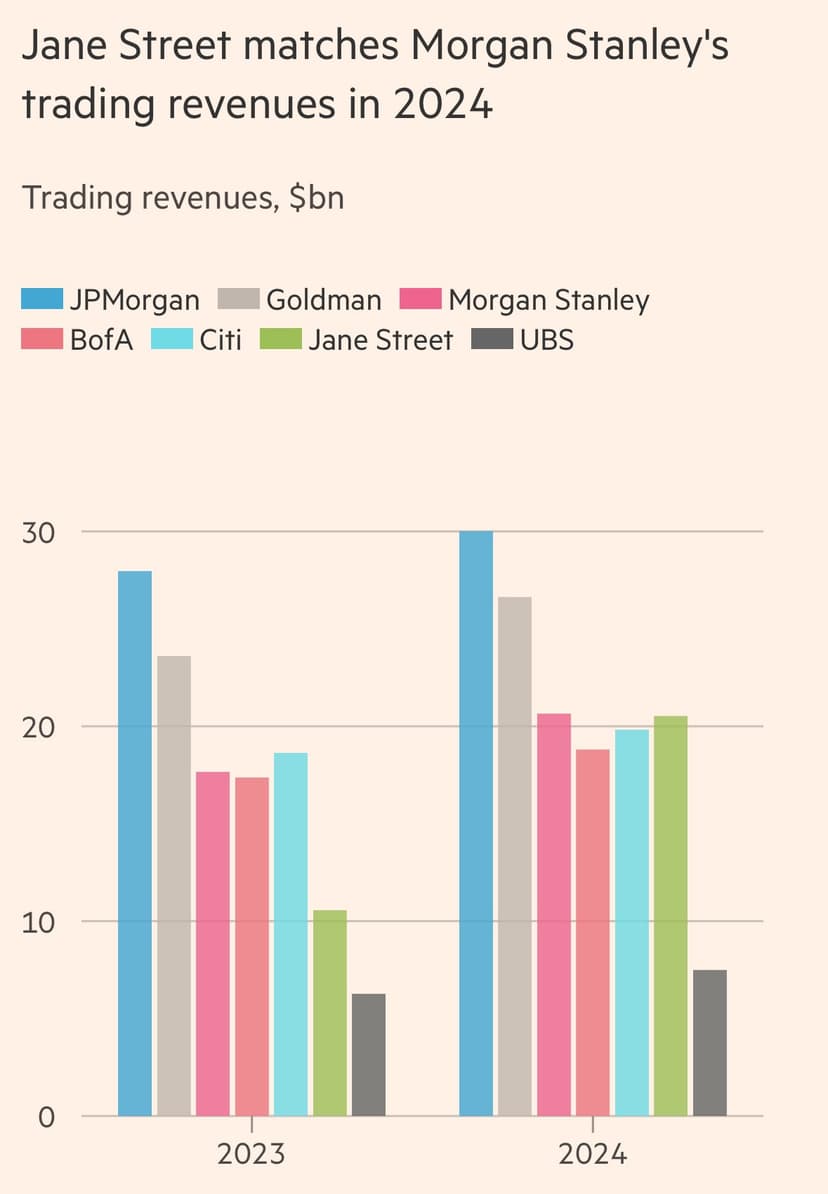

Jane Street's 2024 revenue doubled, surpassing Morgan Stanley, largely due to AI-driven trading. This reflects the industry's shift toward AI-powered quantitative strategies. Major firms invested heavily in GPUs well before the current AI boom — for training on massive historical datasets, analyzing unstructured text (filings, earnings calls, news), and comparing model architectures from LSTMs and XGBoost to Transformers.

The core of quant investing is accessible to AI practitioners. The mystery lies not in intellectual barriers but in information gaps.

How AI Changes the Game

Traditional quant methods apply human-defined indicators to assets and backtest for high returns. When results falter, strategies add more factors and grow more complex. Yet even the best strategies sometimes lose money. Even the Medallion Fund — founded by James Simons in 1988 and widely considered the gold standard — reportedly incurred losses in Q1 2025. This highlights a core issue: human-defined strategy parameters are a finite set. They may work in historical scenarios but fail in edge cases and rare market events.

Deep neural networks, particularly reinforcement learning, offer a fundamentally different approach:

- State: OHLCV data, technical indicators (RSI, MACD, etc.), sentiment signals from news and filings

- Action: Target portfolio weights — long, short, or flat on each instrument

- Reward: Profit and loss, risk-adjusted returns, constraint penalties

This formulation suits large-scale RL training. Compare 100 human-defined parameters to a model with millions of learnable parameters — which better captures complex probability distributions across market regimes? We don't need to understand every neuron's interaction; the model's capacity to represent intricate patterns vastly exceeds manual strategy design.

However, training robust AI quant models demands deep expertise. Most published papers benchmark on S&P 500 data from 2020–2024 — a period dominated by a bull market where even simple strategies outperform. Performance during volatile or bearish cycles requires scrutiny. Most open-source strategies fall short of fund-grade returns and risk controls.

Key considerations for serious AI quant systems:

- Data scale matters: Larger, richer datasets improve model robustness, analogous to scaling laws in LLMs.

- Human expertise as training signal: Beyond static indicators, incorporate expert trader strategies as behavioral priors.

- Hedging is essential: Dynamic markets require models that manage risk, not just maximize returns.

- Capital management is its own model: A mediocre strategy with disciplined position sizing outperforms a brilliant strategy without it.

- One model per strategy, not one model for everything: Markets have distinct regimes and asset classes behave differently.

- Noise filtering is critical: Financial data is abundant but noisy — separating signal from noise is the core challenge.

The Real Barriers

Beyond the technical challenges, several structural barriers define who succeeds:

- Execution speed: For HFT strategies, speed depends on server proximity, hardware performance, code efficiency, and microsecond-level network latency. This is an infrastructure problem, not a modeling problem.

- Counterparty quality: U.S. markets are roughly 80% institutional. Profitable quant funds often profit from other institutions' mispricing, competing on execution speed and algorithmic sophistication.

- Practitioner experience: Real trading has a psychological dimension that backtests can't capture. Novices and veteran traders react to the same market movements very differently. AI offers an advantage here — a sufficiently capable model trades without emotion or fatigue.

- Capital management: Position sizing and risk management are at least as important as signal generation. A mediocre model with excellent capital allocation outperforms a brilliant model without it over any meaningful time horizon.

Even with strong AI tools, no model is foolproof. Models can't anticipate insider trading or purely political market shocks. During the 2025 tariff escalation, monitoring social media and policy signals could predict a bearish trend — but the rebound after a sudden policy reversal was much harder for algorithms to capture. Human judgment often outperforms algorithms in rare events, but their combination is strongest.

Where This Goes Next

This post lays out the landscape — what quant trading is, why AI fits, and where the barriers are. The follow-up, Dnalyaw: Engineering an AI Quant Trading System from Scratch, covers the actual architecture and engineering decisions behind building a production system.

Disclaimer: All trading references use personal funds for educational purposes only and do not constitute investment advice. Trading carries high risks, including potential total loss.